Taxes

If you lived in the United States between Jan. 1 and Dec. 31, 2025, you must file a U.S. tax form.

Did you receive any U.S. Source Income in 2025?

U.S. Source Income includes wages, taxable scholarships, housing stipends, cash awards, etc.

Yes, I received U.S. Source Income

You must file a U.S. tax return with the Internal Revenue Service (IRS). UT Dallas has arranged access to Sprintax Tax Preparation to assist with your Federal tax return. Sprintax is an online tax preparation software, specifically for nonresident alien students. For questions regarding Sprintax software, please contact Sprintax using their live chat function.

UT Dallas students can receive a tax filing discount for 2025 by entering the code F25UTXD3500 in the “review your order” section. Please note this code only applies to your Federal tax return. If you reside in a state that requires state tax returns to be filed, you will be responsible for the costs associated with filing those returns. Approximate costs are listed below:

- State tax preparation: $49.95

- Form 843 (FICA) preparation: $19.95

- ITIN preparation: $19.95

Notes about Sprintax questionnaire Step 5 – About your College/Program:

- University/college details: The University of Texas at Dallas, 800 W. Campbell Road, Richardson, TX 75080, 972-883-2111.

- Program director details: Sarah Ku, 800 W. Campbell Road, SSB34, Richardson, TX 75080, 972-883-4189

Common Tax Forms

W2

Reason

If you received wages (from any employment: on-campus, CPT, OPT, etc.) in the United States during 2025.

Sender

Sent by your employer. Contact your employer’s payroll department if you have not received this form after January. In late January, W-2 forms from UT Dallas will be uploaded to Galaxy – Gemini – Self Service – Payroll and Compensation – View W-2 form tab.

1042-S

Reason

If you received a taxable scholarship/fellowship or claimed tax treaty benefits from a university during 2025. You may also receive this form if you receive interest income from a bank.

Sender

Sent by the payor (university, bank, etc.). 1042-S forms from UT Dallas will be uploaded to your Glacier account in late January. Email taxcompliance@utdallas.edu if you are unsure whether or not you will receive this form from UT Dallas.

1099

Reason

If you received self-employment income, interest income, dividend income, or investment income during 2025.

Sender

Sent by payor (company or individual employer, bank, or investment company) during 2025.

1098-T

Reason

If you enrolled at an eligible education institution and made a reportable transaction to that education institution during 2025.

Sender

1098-T forms from UT Dallas will be issued to students who have a valid Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) on file with the Office of the Registrar. More information can be found on the Bursar Office website.

WARNING: International students who are nonresident aliens for tax purposes are not eligible to claim the education credits associated with the 1098-T form, even if the form is issued to you.

Note: If your U.S source income comes from UT Dallas and you have never completed the foreign national tax compliance process, fill out the Foreign National Tax Compliance Process Form to complete your tax compliance process with the UT Dallas Tax Compliance Office as soon as possible. The foreign national tax compliance process helps UT Dallas determine foreign nationals’ tax residency status, tax withholding rate, eligibility for tax treaty benefits/FICA exemption, and generates necessary tax forms. More information about the foreign national tax compliance process is available on the Tax Compliance Office website.

No, I did not receive U.S. Source Income

You must complete and mail IRS form 8843. Form 8843 and instructions are found on the IRS website. If you would like guidance on this form, please view the video below:

Notes about form 8843:

- Item 9 = The University of Texas at Dallas, 800 W. Campbell Road, Richardson, TX 75080, 972-883-2111.

- Item 10 = Sarah Ku, 800 W. Campbell Road, SSB34, Richardson, TX 75080, 972-883-4189.

Tax Filing Webinars for FY2025

Sprintax Nonresident Tax Webinars

In these tax webinars, international students, scholars and professionals will be run through everything they need to know about nonresident tax for the 2025 tax season. Topics will include who must file, tax residency, FICA, State returns, implications of misfiling as well as how to use Sprintax to prepare a compliant tax return.

- Tues Dec 9th @ 12pm ET – Register here

- Jan 20th @ 10am ET – Register here

- Jan 28th @ 12pm ET – Register here

- Feb 5th @ 1pm ET – Register here

- Feb 10th @ 7pm ET – Register here

- Feb 18th @ 3pm ET – Register here

- Feb 24th @ 10am ET – Register here

- Mar 5th @ 12pm ET – Register here

- Mar 11th @ 1pm ET – Register here

- Mar 16th @ 2pm ET – Register here

- Mar 27th @ 11am ET – Register here

- Apr 1st @ 1pm ET – Register here

- Apr 7th @ 8am ET – Register here

- Apr 14th @ 2pm ET – Register here

Sprintax Tax Webinar for CPT/OPT:

- Jan 8th @ 2pm ET – Register here

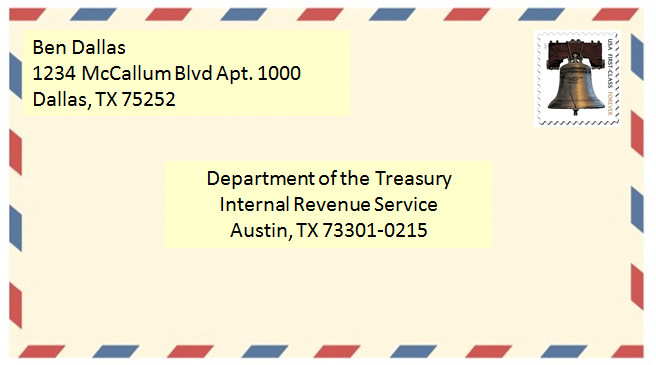

How to Mail Your Tax Return

For Form 1040-NR, U.S. Nonresident Alien Income Tax Return (if not enclosing a payment)

Address mail to (see sample below):

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

For Form 1040-NR, U.S. Nonresident Alien Income Tax Return (if enclosing a payment)

Address mail to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

- If you need stamps, stamps are available at the Comet Card Office.

- A blue USPS mailbox is located in Lot A.

Who to Contact for More Information

If you have any additional questions about tax filing, contact the UT Dallas Tax Compliance Office at taxcompliance@utdallas.edu.

You also may view the Tax Season FAQ Form for International Students.

IRS Scams

During tax season, be aware of phone and email scams that target international students. These scams involve persons falsely representing themselves as a representative of the IRS, USCIS, or another government agency.

Here are some tips to protect yourself against scams:

- File your tax return as early as possible.

- Know the IRS will not contact you by email, text or social media.

- Do not give out any personal information (ex. Social Security Number, bank account number, credit card information, etc.) over the phone or via email.

- Shred paper copies of your tax returns and financial documents when no longer needed.

- If you receive a suspicious phone call or email, do not respond until you verify with the appropriate people that it is true. Scams can be reported to the: